Overview

Venture capital managers are expanding investments and strategies to meet ever-changing investor objectives, including pursuing secondary investments, co-investments, public market investments, or structured credit opportunities. However, managers should review the SEC registration requirements and understand the business changes that could change registration status or require a manager to become an RIA.

How do Managers Qualify for Exemptions from SEC Registration?

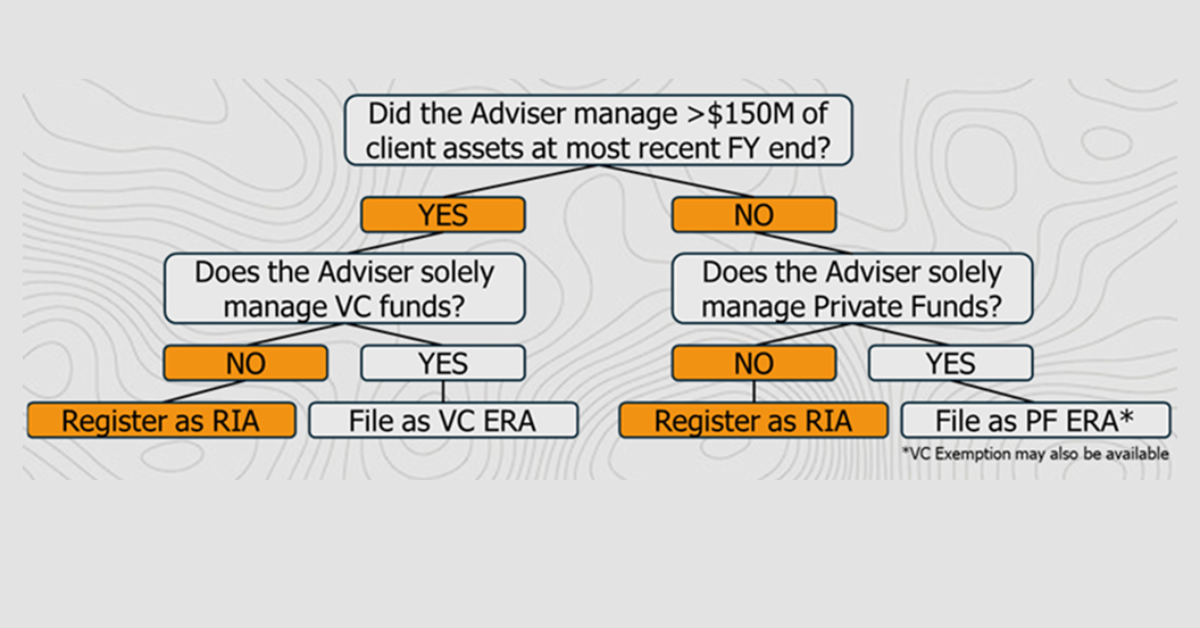

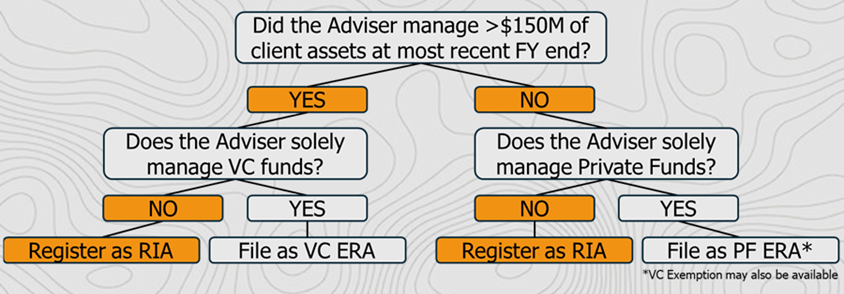

Venture capital advisers can qualify for an exemption from registration in two ways, either via the Private Fund Adviser Exemption (“PF Exemption”) or the Venture Capital Fund Adviser Exemption (“VC Exemption”).[1]

Venture capital advisers can qualify for an exemption from registration in two ways, either via the Private Fund Adviser Exemption (“PF Exemption”) or the Venture Capital Fund Adviser Exemption (“VC Exemption”).[1]

Exempt Reporting Advisers (“ERAs”), advisers relying upon the PF Exemption or the VC Exemption, are not required to register with the SEC or most state regulators but are subject to certain reporting, recordkeeping, and other compliance obligations.

The PF Exemption is generally available to advisers that only manage private funds and have less than $150 million in assets under management (“AUM”). Conversely, the VC Exemption is generally available to advisers that solely manage venture capital funds.

When Must an ERA Become a Registered Investment Adviser (“RIA”)?

When relying on the PF Exemption, ERAs must calculate assets under management at the end of each fiscal year. If AUM exceeds the $150 million threshold at fiscal year-end, the ERA must transition into an RIA with the SEC in the following fiscal year. For example, assuming a December fiscal year, an ERA that manages more than $150 million in AUM on December 31, 2024, will be required to report the increased figure on its annual Form ADV amendment due March 31, 2025, and transition to RIA status no later than June 30, 2025. Alternatively, suppose the same ERA calculates less than $150 million in AUM on December 31, 2024, but later exceeds $150 million in AUM during the first quarter of 2025. In that case, it will only be required to report the sub-$150 million figure as of the most recent fiscal year-end on its annual Form ADV amendment due March 31, 2025. Assuming AUM remains at or above $150 million for the remainder of 2025, the ERA would report the increased figure on its annual Form ADV amendment due March 31, 2026, and transition to RIA status no later than June 30, 2026.

When ERAs relying on the VC Exemption no longer manage solely “venture capital funds,” they too are required to transition to RIA status. The most common disqualifying deviations include excess non-qualifying assets within the fund or a new ancillary strategy managed in addition to the venture capital fund. In the first case, an ERA causing its fund to invest more than 20% of commitments in a secondary deal will immediately forfeit its VC Exemption. Additionally, an ERA that decides to launch a separately managed account or complimentary hedge fund strategy, for example, would similarly forfeit its VC Exemption and be required to transition to RIA status.

It’s important to note that the PF Exemption and VC Exemption are not mutually exclusive. It is possible to qualify for both exemptions and rely on one after the other is no longer available.

What is the Timeline for Transitioning from an ERA to an RIA?

An ERA relying on the VC Exemption, that cannot rely on the PF Exemption, would require an immediate transition to RIA status in the event of a disqualifying investment or a non-venture capital fund launch. On the other hand, a non-venture capital fund manager relying on the PF Exemption that exceeds $150 million in AUM during the first fiscal quarter could have up to 18 months to complete the same transition. In each case, the steps to registration are the same, but the pace and path to registration can vary depending on the adviser’s circumstances.

What are the Key Compliance and Filing Obligations of an RIA?

RIAs are subject to more comprehensive regulatory oversight, fiduciary standards, and detailed compliance requirements including but not limited to:

- Designating a Chief Compliance Officer

- Developing a Compliance Manual

- Monitoring Employee Personal Trading

- Maintaining Compliant Performance Records

- Drafting Part 2A of Form ADV

- Archiving Electronic Communications

- Conducting an Annual Program Review

- Filing Form PF for Each Fund

Can ERAs Be Examined by the SEC?

Yes, while RIAs are more likely to be examined, the SEC has the authority to examine ERAs under certain conditions, especially if there are compliance concerns, significant changes in business operations, or specific tips or complaints from investors. In certain cases, ERAs have been referred to the SEC’s Division of Enforcement:

- Several ERAs have been fined for contributions made by employees to political candidates while an associated government entity is a current fund investor.

- ERAs have also been fined for failure to comply with fund agreements (specifically failure to complete an audit required by a fund agreement) and inter-fund transactions and loans that violated fund agreements.

- The SEC has recently penalized ERAs for making materially misleading statements regarding management fee calculations and incorrectly calculating management fees.

Most RIAs are likely to be examined by the SEC within 12-18 months of initial registration – or following the transition from ERA to RIA status.

About HighCamp Compliance

HighCamp is a boutique compliance consulting and outsourcing firm helmed by former SEC examiners, CCOs, and proven consulting professionals. The firm specializes in regulatory compliance and operational support for SEC-registered private equity, real estate, venture capital, hedge fund, and institutional alternative managers. HighCamp is 100 percent employee-owned, with a gender-balanced leadership team. The company has locations in Bozeman, Dallas, Denver, Los Angeles, Milwaukee, and New York City (Metro).

[1] Additional considerations apply for non-U.S. exempt reporting advisers that are outside of the scope of this whitepaper.