On October 21, 2024, the U.S. Securities and Exchange Commission’s (“SEC”) Division of Examinations (the “Division”) announced its examination priorities for fiscal year 2025 (the “Exam Priorities”). These priorities were developed in consultation with other divisions and offices throughout the SEC and will serve to guide the Division’s focus when conducting registrant examinations for the next 12 months.

The Division’s stated focus areas relevant to all registered investment advisers in 2025 include:

- Adherence to Fiduciary Standards of Conduct. The Division plans to continue its focus on whether investment advice provided to clients satisfies the adviser’s fiduciary duty, with a particular emphasis on high-cost products, unconventional instruments, illiquid and difficult-to-value assets, and assets sensitive to changes in the interest rate environment or market conditions, including commercial real estate. The Division will also focus on advisers’ conflicts of interest and their impact on investment advice and best execution, as well as certain conflicts relating to investment advisers that are also registered as, or are affiliated with, broker-dealers.

- Effectiveness of Advisers’ Compliance Programs. As in prior years, the Division will examine advisers’ compliance programs, including by evaluating policies and procedures around marketing, valuation, trading, portfolio management, filings and disclosures, and custody, as well as analyzing the results of advisers’ annual compliance program reviews. In particular, the Division indicates that it will focus on policies governing advisers’ relationships with third parties to whom the adviser delegates investment management responsibilities, any alternative sources of revenue or benefits received by the adviser, and the appropriateness and accuracy of fee calculations and the disclosure of related conflicts.

The Division also announced a number of examination focus areas specifically relevant to private fund advisers. These include:

- Fund Management in Response to Market Fluctuations. The Division plans to focus on private funds that were exposed to market volatility and interest rate fluctuations and whether the adviser appropriately managed such conditions. The Division indicates that it may especially scrutinize funds that experienced poor performance, significant withdrawals, or increased leverage as a result of market events.

- Private Fund Fees and Expenses. The Division will assess the accuracy of calculations and allocations of private fund fees and expenses, including valuation of illiquid assets, calculation of post-commitment period management fees, and fee offsets.

- Conflicts of Interest. Consistent with past examination practices, the Division will assess the adequacy of advisers’ disclosures of conflicts of interest and related risks, as well as policies designed to mitigate such conflicts. Particular areas of focus include the use of credit facilities, investment allocations, adviser-led secondary transactions, cross-fund investments, and the use of affiliated service providers.

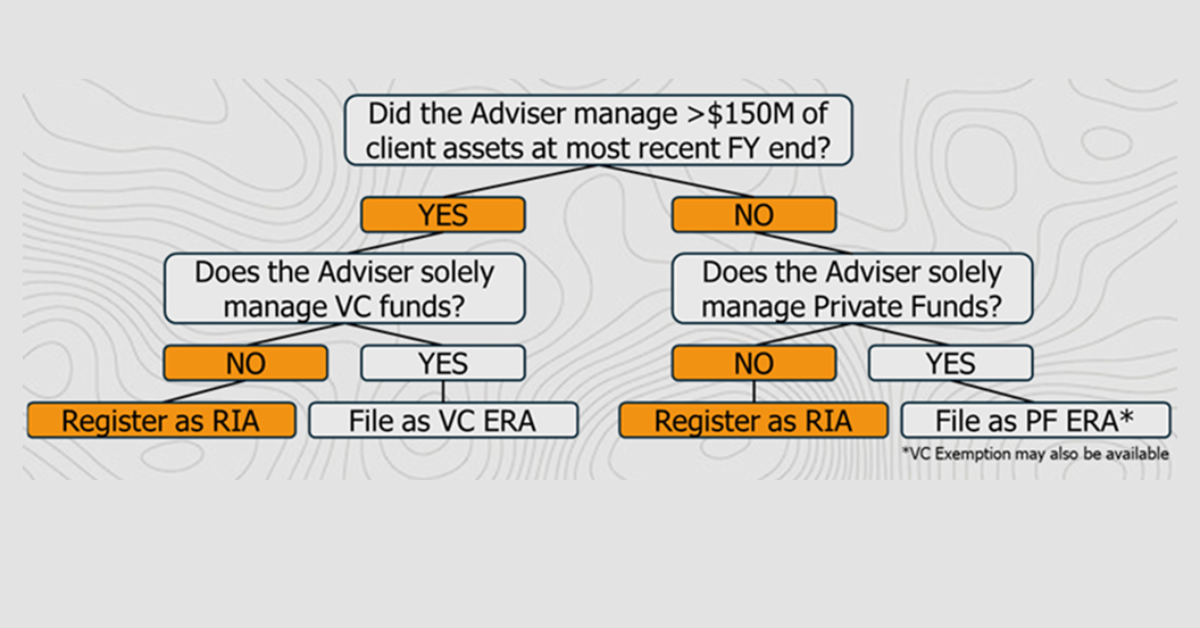

- Compliance with New SEC Rules. The Division indicates it will continue to review advisers’ compliance with recently adopted SEC rules, including amendments to Form PF and the new Marketing Rule.

In addition to the above, the Division indicates it will continue to prioritize examinations of advisers that are recent registrants or otherwise have never been examined.

Finally, the Division notes a number of focus areas that apply to SEC registrants of all kinds, including investment advisers. Under this category, the Division references:

- Cybersecurity. As in past years the Division will continue to review registrant practices to prevent interruptions to business operations and protect client information and assets from cyber-attacks. Notable areas specifically mentioned in the Exam Priorities include data loss prevention controls and responses to cyber-related incidents.

- Regulation S-ID and Regulation S-P. In a change from prior years, the Division indicates it will pay close attention to registrants’ compliance with Regulations S-ID and S-P, which govern advisers’ identity theft-prevention programs and privacy controls, respectively. According to the Exam Priorities, the Division will emphasize related policies and procedures, internal controls, oversight of third-party vendors, and governance practices. Of particular note, the Division plans to assess measures to detect customer account takeovers and fraudulent transfers, prevent account intrusions, and provide staff with identity theft-prevention training.

- Shortening of the Settlement Cycle. For those advisers that trade public securities, the Division will assess compliance with amended books and records requirements, operational changes, and impacts to clients as a result of the shortening of the settlement cycle to T+1.

- Emerging Financial Technologies. The Division plans to remain focused on registrants’ use of automated investment tools, artificial intelligence (“AI”), and trading algorithms and platforms, as well as alternative sources of data (e.g., web scraping). When conducting exams, the Division will assess whether technology-related representations and disclosures are accurate, whether appropriate controls have been adopted, whether algorithms used to produce investment recommendations are consistent with stated strategies and client priorities, and whether the adviser has implemented measures to confirm that advice and recommendations generated by digital tools are consistent with regulatory obligations to investors. With respect to AI specifically, the Division will review registrants’ representations regarding their use of AI, whether registrants have adopted adequate policies and procedures to monitor employee use of AI, and whether advisers have implemented appropriate privacy controls with respect to employees’ use of AI.

- Digital Assets. The Division states it will continue to examine registrants offering crypto-related services, as well as the offer, sale, recommendation, advice, trading, and other activities involving digital assets that are sold as securities or related products. The Division indicated it would place special emphasis on advisers that recommend digital assets to retail investors and whether advisers involved in digital asset investing routinely review and update their compliance practices, custody policies, anti-money laundering measures, valuation procedures, risk disclosures, and operational resiliency practices. Security of client holdings in digital assets will also be a focus area.

- Anti-Money Laundering. The Division plans to review whether investment advisers are monitoring the Department of Treasury’s Office of Foreign Assets Control sanctions.

While many of the above examination priorities are carried over from prior fiscal years, the focus on Regulation S-ID, Regulation S-P, and AI will give advisers new risk areas to tidy up prior to potentially being examined in 2025.

About HighCamp Compliance

HighCamp is a boutique compliance consulting and outsourcing firm helmed by former SEC examiners, CCOs and proven consulting professionals. The firm specializes in regulatory compliance and operational support for SEC-registered private equity, real estate, venture capital, hedge fund, and institutional alternative managers. HighCamp is 100-percent employee owned, with a gender-balanced leadership team. The company has locations in New York City (Metro), Los Angeles, Denver, Dallas, Milwaukee, and Bozeman.