Guidance, Enforcement, Hot Topics, & More

Happy New Year. At HighCamp, we celebrate our clients’ milestones as if they were our own. We are very fortunate to have longstanding relationships with our clients and the best seats in the proverbial stadium to support their wins. From new fund launches to continued top quartile performance to building great businesses and cultures, our clients continued to excel in 2022. And we are very proud to support their growth.

HighCamp’s value to our clients remains centered on our commitment to providing the best service and deep expertise within our niche. Our client service starts with our unique structure and strong team. Most of our team members have equity and are therefore aligned in the long-term success of our client relationships. We’ve gone out of our way to protect our objectivity and the ability of our team to put our clients’ interest first. The result of this approach can be seen in our industry–leading client retention and examination results and our ability to attract top talent to the team.

If you have been reading my year-end letters over the years, you know that I’m a big fan of five-year goal setting. We believe our clients value that all company decisions are based on long-term goals rather than seeking out short-term wins. Our goals are both qualitative and quantitative. For me, the achievement of a quantitative KPI has never been as accurate an indicator of our overall success than our team members’ desire to get out of bed and get after it. Said another way, we are focused on doing good work with the right people and I believe the so-called American tailwinds will largely take care of the rest.

During times of market volatility, I believe it is even more important to stay committed to this approach. Last year’s macroeconomic outlook was as dim as any year in HighCamp’s six-year operating history, sans maybe the early months of the pandemic. Yet, based on our commitment to our team and our clients and our work, our company headlines remained as bright as ever. I’m not saying our business isn’t affected by macroeconomic factors; we all are. But I do feel comfortable our approach and commitment to our principles will keep our long-term objectives in reach.

Thank you to my team, clients, and industry friends that have believed in HighCamp and continue to support our story. I feel like I have the best job in the world and am very fortunate to work alongside so many great people for another year.

Cheers to 2023,

Brad Burgtorf

Pressing Regulatory Items for 2023

Our 2022 predictions mostly played out as forecasted in last year’s letter, although “shadow trading” insider trading cases wound up being a big nothing burger contrary to our expectations. Below are this year’s predictions for 2023 key areas of interest.

- SEC indicates an aggressive plan to finalize and propose new rulemaking. Key rule proposals for investment advisers that could be finalized in 2023 include private fund reform, cybersecurity, ESG, expanded Form PF reporting, and surveillance of outsourcing arrangements, among others. The primary industry argument against the proposals is that the existing rulebook already addresses most of the so-called risks being raised. In any event, it is shaping up to be an active year of new rulemaking.

- A potential for a prolonged market downturn raises inherent compliance challenges relating to, among other things, liquidity, valuation, and investor litigation.

- SEC official commentary, as well as in reported enforcement results, reflected a decline in disgorgement penalties, but a significant increase in overall civil penalties in 2022. The shift in SEC enforcement strategy away from disgorgement and toward proactive sweeps and initiatives targeting specific technical issues like custody, political contributions, and electronic communications is expected to continue in 2023. The focus on penalties where disgorgement is not appropriate will result in “foot fault” violations being referred for enforcement actions.

- Onsite and in-person SEC examinations are forecasted to resume in 2023. In our view, onsite examinations entail more depth and scrutiny than most post-pandemic correspondence examinations. However, the SEC’s budget and union policies may limit examiners’ widespread return to onsite examinations.

- Identification and management of conflicts of interest and handling of inside information remain a top priority for industry participants and regulators alike.

- Electronic communications remain a challenge. Vulnerabilities are widespread and regulators know it. Employee training and certifications, and leadership from the top, are critical mitigants in this area.

- The new marketing rule is here. The first FAQ of the year was released to clarify requirements around net performance reporting for extracted performance. We expect more “clarifications” throughout the upcoming year through more FAQs, examination findings, and enforcement actions.

- Whether through rulemaking or enforcement actions, digital assets will continue to absorb a significant amount of SEC resources and headlines in response to the latest “crypto winter.”

- We expect ESG to continue to be a focus for regulators seeking out “greenwashing” and non-compliance with policies and procedures.

Fourth Quarter Headlines

Risk Alert: Observations from Examinations Related to Regulation S-ID

On December 5, the SEC’s Division of Examinations (“EXAMS”) issued a Risk Alert highlighting firms’ failure to identify covered accounts, conduct risk assessments, and create programs tailored to the business or that covered all required elements of Regulation S-ID. Additionally, the Risk Alert noted ways in which firms failed to identify, detect, and respond to red flags. Finally, EXAMS pointed out inadequate training of advisers’ employees as well as poor controls over service providers who performed actions in connection with covered accounts.

SEC Compliance Outreach Program

On November 15, the SEC hosted a Compliance Outreach program for Investment Advisers and regulatory personnel. Richard Best previewed some of EXAMS’ priorities moving forward including ESG, Private Funds, custody rule compliance, and standards of conduct. Director Grewal stated that firms should use previous electronic communications enforcement actions as a roadmap to compliance. Additionally, there was a focus on Private Funds and making sure advisers are fair with their fees and expenses and ensuring that disclosures align with the practice of the adviser’s business.

SEC Proposes New Oversight Requirements for Certain Services Outsourced by Investment Advisers

On October 26, the SEC proposed a new rule establishing formal due diligence and monitoring of certain third-party service providers used by advisers. Among proposed requirements, advisers would need to be able to document their analyses of the scope of work the provider is performing, the service provider’s subcontracting arrangements, and potential risks to the adviser relating to work performed by the provider. Additionally, the adviser would be required to periodically assess the work of the provider as well as report census-type information about the providers on Form ADV. Industry comments are generally supportive of the risks associated with advisers’ expanding their outsourcing arrangements, but also provide additional perspective and concerns regarding whether the proposal and associated costs are necessary given the existing tools available to address such risks.

2022 Trends

Examination Recap

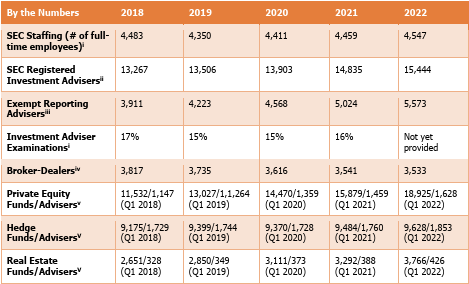

The Division of Examinations (“EXAMS”) utilizes multiple methods for targeting advisers to examine, including the entity’s risk profile, a tip, complaint, or referral, and review of a particular risk area. In FY22, EXAMS conducted reviews focused on Regulation Best Interest and the Advisers Act fiduciary standard, private funds, information security and operational resiliency, emerging technology and financial innovation, and ESG investing. EXAMS kept busy publishing seven Risk Alerts in FY22.

Did you know?

Despite cybersecurity/information security being a perennial focus during EXAMS, less than 2 percent of registered investment advisers in FY 2022 (or 312 examinations in total[i]) received document requests from EXAMS related to cybersecurity/information security.

Enforcement Highlights

- The Division of Enforcement (“Enforcement”) brought 760 actions (a 9% decrease from FY21) in which it obtained record financial remedies of more than $6.4 billion and awarded $229 million (a 59% decrease from FY21) to 103 whistleblowers.

- Twenty-six percent of standalone enforcement actions involved investment adviser/company issues, which is down from 28% in FY21. Nine percent of standalone enforcement actions involved insider trading.

- Enforcement has sought to “re-calibrate penalties to more effectively promote deterrence and get away from the idea that penalties are just another business expense.” In the previous five years, the Commission ordered more than twice as much in disgorgement as it did in penalties. In FY22, that ratio flipped and penalties were nearly twice as high as disgorgements.

Q4 Key Enforcement Actions and News

We left off on September 30, 2022 in our Q3 Letter. Please note all sources are hyperlinked rather than footnoted.

SEC Charges Two Individuals with Defrauding Investors in FTX

On December 21, the SEC announced charges against Caroline Ellison and Gary Wang for their roles in defrauding equity investors in FTX. Among other things, Ellison is accused of manipulating the price of FTT, the FTX-issued token that allegedly served as collateral for undisclosed loans by FTX to its hedge fund affiliate, Alameda Research. Wang is accused of writing the software code that allowed Alameda to divert FTX customer funds.

SEC Charges Two Individuals in $47 Million Front-Running Scheme

On December 14, the SEC charged a trader at a major asset management firm with tipping a contact ahead of making large market-moving trades for his employer’s clients. The long-standing scheme allegedly lasted over five years and involved the individuals using pre-paid phones to send thousands of messages containing MNPI. The contact’s dollar-weighted win rate was roughly 90% throughout the alleged front-running scheme.

SEC Settles with Individual for Trading on MNPI Gained Through Acquisition Talks

On December 6, the SEC settled charges against an individual for allegedly trading on the basis of MNPI he obtained while performing due diligence on a company in preparation for a potential acquisition. The individual allegedly obtained ill-gotten gains of $6,300.

SEC Settles with Adviser for Basic Compliance Program Violations

On December 5, the SEC charged an adviser for allegedly failing to adopt and implement reasonably designed compliance policies and procedures, conduct annual compliance program reviews, establish and maintain a written code of ethics, and file and post Form CRS on a timely basis as required under the Advisers Act.

SEC Sues Goldman Sachs for Failing to Follow Its ESG Policies & Procedures

On November 22, the SEC settled charges against Goldman Sachs Asset Management, L.P. for allegedly failing to implement ESG policies and procedures for two of its ESG-focused mutual funds and one ESG-focused separately managed account. Once policies and procedures were in place, the SEC alleged, Goldman managers did not always follow them and failed to complete an ESG questionnaire they represented to investors as part of the investment process.

SEC Settles with Adviser for Failing to Obtain Consent on Principal Trades

On November 21, the SEC settled with an adviser who allegedly executed cross trades between client accounts to avoid commissions but, in doing so, failed to comply with restrictions on principal transactions. Due to poor internal account classifications, the adviser allegedly failed to disclose and obtain consent for over 44,000 principal trades during the examination period.

Director Grewal’s Remarks at Securities Enforcement Forum

On November 15, Director Grewal provided an update from Enforcement’s 2022 fiscal year. Among other things, Grewal noted the increased penalties Enforcement handed out (including admissions of wrongdoing) and the continued goal of proactive enforcement through the use of sweeps and initiatives.

SEC Charges Kim Kardashian

On October 3, the SEC settled with Kim Kardashian for allegedly promoting a crypto token on her Instagram account without disclosing that she was being compensated for doing so. The Commission found the token to be a security and said Kardashian violated Section 17(b) of the Securities Act. Additionally, the release highlights how this event occurred after Enforcement warned against celebrities promoting crypto without disclosing the compensation they received.

Q1 Upcoming Key Reporting & Disclosure Deadlines

| January 30, 2023 | Q4 2022 Quarterly Transaction Reports Due |

| February 14, 2023 | Form 13F Due

Annual Form 13H Due Annual Schedule 13G (and any amendments) Due Annual Access Person Holdings Due |

| March 1, 2023 | Quarterly Form PF for Large Hedge Fund Advisers (for Q4 2022)

NFA PF for Large Hedge Fund Advisers |

| March 31, 2023 | Form ADV Annual Amendment Due

State Notice Filings (if any required by states) Due |

| April 30, 2023 | Annual Form PF Due

Deliver Audited Financial Statements to Private Fund Investors Deliver Updated Form ADV Part 2A (or summary of material changes) to Investors Q1 2023 Quarterly Transaction Reports Due |

About HighCamp Compliance

HighCamp is a boutique compliance consulting and outsourcing firm helmed by former SEC examiners, CCOs and proven consulting professionals. HighCamp specializes in regulatory compliance and operational support for SEC-registered private equity, real estate, venture capital, hedge fund, and institutional alternative managers. HighCamp is 100-percent employee owned, with a gender-balanced leadership team. The company has locations in New York City (Metro), Los Angeles, Denver, Milwaukee, and Bozeman.

[i] https://www.sec.gov/files/sec-2022-agency-financial-report.pdf

[ii] https://www.sec.gov/help/foiadocsinvafoiahtm.html

[iii] https://www.sec.gov/help/foiadocsinvafoiahtm.html

[iv] https://www.sec.gov/help/foiadocsbdfoiahtm.html

[v] Private Fund Statistics, October 14, 2022, https://www.sec.gov/divisions/investment/private-funds-statistics/private-funds-statistics-2022-q1.pdf