On March 3, the SEC’s Division of Examinations (“EXAMS”, or the “Division”, formerly known as the Office of Compliance Inspections and Examinations or OCIE) released their 2021 exam priorities. As the industry expected, the impact of the COVID-19 pandemic, everchanging climate risks and ESG have proved to be at the top of the list this year. Here we’ll summarize highlights of EXAMS’ 2021 priorities for private fund managers.

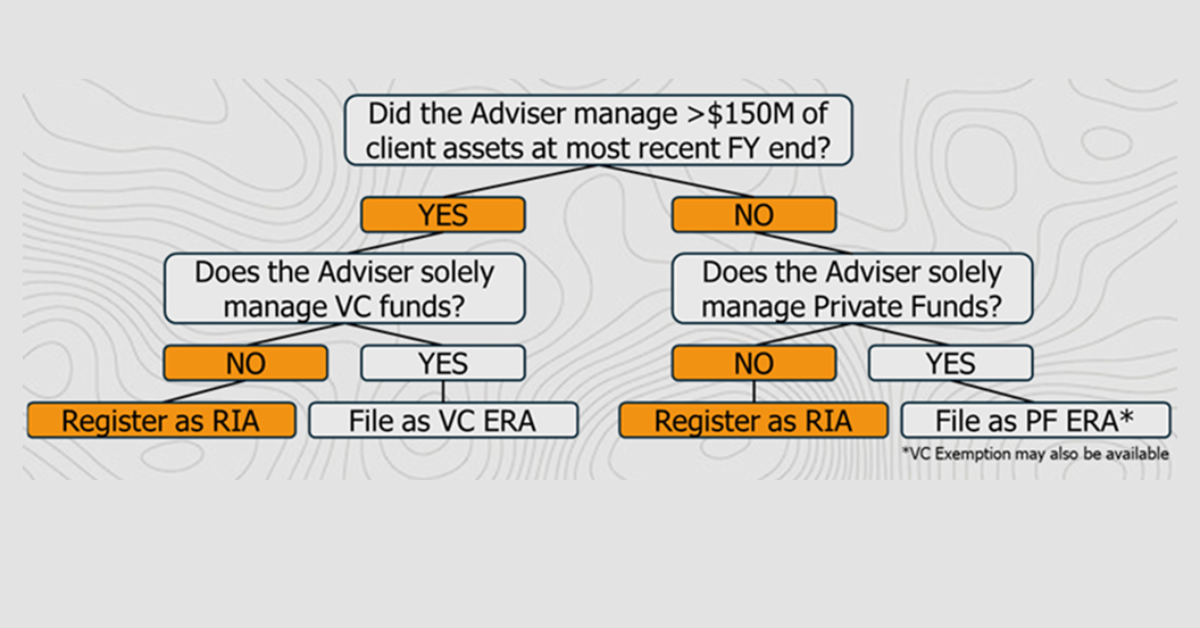

Registered Investment Advisers (“RIA”) to Private Funds – The Division will continue to focus on advisers to private funds and will assess compliance risks, including:

- Preferential treatment of certain investors by advisers to private funds that have experienced issues with liquidity (e.g., imposing gates or suspensions on fund withdrawals);

- Advisers with a higher concentration of structured products (e.g., collateralized loan obligations or mortgage-backed securities) and adequate disclosures of risks associated with non-performing loans;

- Scenarios that create conflicts around liquidity such as adviser-led fund restructurings, including stapled secondary transactions;

- Cross trades, principal investments, or distressed sales and whether advisers are providing adequate disclosures and complying with regulatory requirements;

- Fund valuation consistency and methodology appropriateness, and impact to management fees;

- Compliance with the recent changes to the definition of accredited investor when recommending and selling certain private offerings.

Environmental, Social and Governance (“ESG”) – Due to investor demand, RIAs are increasingly offering investment strategies that focus on sustainability. These strategies may include products and services that are referred to by a variety of terms such as ‘sustainable’, ‘socially responsible’, ‘impact’, and ‘ESG conscious’.

- EXAMS will focus on products in these areas that are widely available to investors such as open-end funds and ETFs, as well as those offered to accredited investors such as qualified opportunity funds.

- As part of their exams, the SEC will be looking to see if advisers’ practices match up with their disclosures, including advertisements and proxy voting procedures and votes to assess whether they align with the strategies.

- Subsequent to the issuance of the 2021 exam priorities, the SEC announced the creation of the Climate and ESG Task Force in the Division of Investment Management, which will initially, among other things, “analyse disclosure and compliance issues relating to investment advisers’ and funds’ ESG strategies.” In addition, the Climate and ESG Task Force will evaluate and pursue tips, referrals, and whistleblower complaints on ESG-related issues.

Information Security and Operational Resiliency – The increase in remote operations due to COVID-19 has increased concerns about, among other things, endpoint security, data loss, remote access, use of third-party communication systems, and vendor management. The Division will review whether advisers have taken appropriate measures to:

- Safeguard customer accounts and prevent account intrusions, including verifying an investor’s identity to prevent unauthorized account access;

- Oversee vendors and service providers;

- Address malicious email activities, such as phishing or account intrusions;

- Respond to incidents, including those related to ransomware attacks; and

- Manage operational risk as a result of dispersed employees in a work-from-home environment.

Business Continuity Planning – Due to substantial disruptions to normal business operations in the past year, the Division will again be reviewing registrants’ business continuity and disaster recovery plans. The Division will shift its focus to whether such plans, particularly those of systemically important registrants, account for the growing physical and other relevant risks associated with climate change.

Other Examination Focus Areas – The Division will also focus on some recent regulatory updates and requirements.

- In 2019, the SEC adopted Regulations Best Interest (Reg BI), Form CRS, and Interpretation Regarding Standard of Conduct. EXAMS will be focusing on RIAs compliance with Form CRS requirements (including delivery to clients), broker-dealer and associated person compliance with Reg BI, and examine RIAs to assess whether, as fiduciaries, they have fulfilled their duty of care and duty of loyalty.

- Due to the discontinuation of LIBOR, the Division will assess registrants understanding of any exposure to LIBOR and their preparations for the transition away from LIBOR and to an alternative reference rate.

Lastly, the report mentioned the importance of knowledgeable and empowered CCOs “with full responsibility, authority, and resources to develop and enforce policies and procedures of the firm.” Last November, Director Driscoll gave a speech highlighting his views on what it means to have an empowered CCO and addressed advisers’ continued need to address compliance, such that it has adequate resources commensurate with the role.

About HighCamp Compliance

HighCamp Compliance is a premier, boutique compliance consulting and outsourcing firm helmed by former SEC examiners, CCOs, and proven consulting professionals. HighCamp specializes in regulatory compliance and operational support for SEC-registered alternative and institutional investment managers. The team includes specialists in private equity, real estate, and hedge funds.